Simon vs. Ehrlich, Round 2

Roger Pielke Jr. made an observation on his blog recently regarding the past decade’s rapid increase in commodity prices and the classic debate between optimistic Cornucopians and pessimistic Malthusians. In 01990 ecologist Paul Ehrlich – who has spoken at The Long Now Foundation’s SALT series – lost a decade-long bet to economist Julian Simon. In 01980, Simon had predicted that prices (of just about everything) would continue to fall as the human population increased. They tracked the price of five metals over the course of the next ten years, and they all became less expensive.

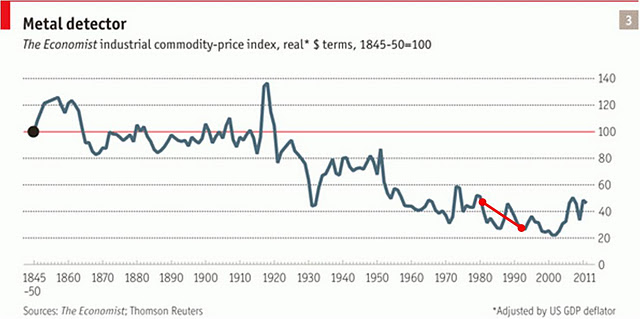

Since the beginning of the millennium, however, prices have risen fairly steadily. In August of 02011, The Economist noted that current prices of the five metals chosen for the Ehrlich – Simon bet exceeded 01980 prices. Had the bet lasted for three decades, rather than one, Ehrlich would have won.

What Pielke points out, however, is that if we zoom out even further and look at The Economist’s records since 1845, the last decade’s spike in prices could be interpreted as one more blip in a long-term trend of Cornucopian price decreases. Or is the global economy showing the first signs of a long-in-coming collapse, as predicted by Malthusians?

Long-term bets such as the $1,000 wager between Simon and Ehrlich can place people’s predictions about the future out in the open for public scrutiny and comment – encouraging those who would speak to think carefully before they do so. One project of The Long Now Foundation, Long Bets, provides a forum for long-term bets and discussion. On the site, you can view current bets, place your own, or challenge someone else’s prediction.

Join our newsletter for the latest in long-term thinking

Subscribe